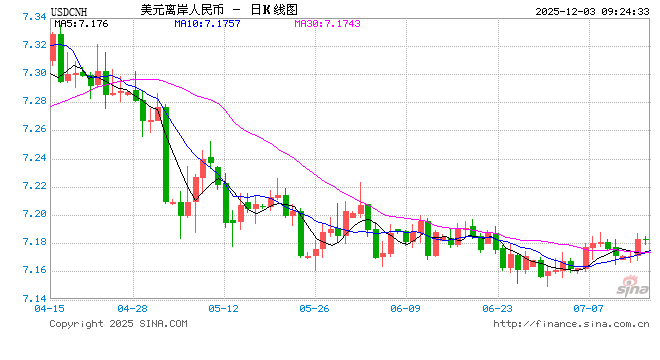

Investment Focus ActionWith the continuous relaxation of China’s entry policies,inbound travel to China has gradually gained traction in recentyears. Meanwhile, the growth in tourist arrivals and adjustmentsto the departure tax refund policy have injected new momentuminto the domestic consumer market in the form of an inboundshopping boom. We believe that tourist spending at airportsmay benefit modestly from the boom, particularly at largeinternational airports. However, there remain some constraints. Reasoning The number of inbound foreign tourists grew rapidly YoYthanks to the relaxation of entry policies. Since the end of2023, the National Immigration Administration, the Ministry ofForeign Affairs, and other authorities have implemented aseries of measures to relax entry policies. Coupled withfavorable exchange rates and inflation, the number of foreigntourists visiting China increased rapidly. According to the National Immigration Administration, theoverall number of inbound and outbound tourists on theChinese mainland in 2Q25 recovered to 96% of the level in2Q19. Specifically, the number of inbound and outbound foreigntourists increased 28% YoY, recovering to 82% of the 2Q19level. Since 1Q24, the pace of recovery has been largelysteady, accelerating by about 5ppt per quarter on average. Shopping in China remains popular among foreigntourists, who favor cultural products and those withcompetitive prices. We estimate that the average spending ofinbound tourists in China stood at US$714 in 2024. In our view,international tourists’ spending is characterized by a focus onquality and experience―for example, they tend to spend moreon hotels. But we also believe their spending on shopping inChina still has growth potential. The optimization of the tax refund policy in April 2025significantly stimulated related product purchases. From theperspective of shopping preferences, we believe inboundforeign tourists prefer products with Chinese characteristics,rarity, or price advantages, such as luxury goods, China-madeelectronic products, as well as traditional and trendy Chineseproducts. We think tourist spending at airports may slightly benefitfrom the inbound shopping boom, constraints may remain.We expect both duty-free shops (DFS) and non-DFS to benefitfrom the growth momentum of inbound tourist spending, but theincreases in their earnings are likely to be limited under currentcircumstances. For non-DFS, we believe such shops do not lack productcategories favored by foreigners, but their sales performancehas likely been constrained by tourists’ duration of stay atairports, store layout, and tax refund qualifications. For DFS,we note that DFS at Chinese airports mainly sell cosmetics andperfumes at competitive prices, but foreign tourists have noteffectively boosted growth in per customer transactions,possibly due to their consumption habits. Earnings forecast and valuationWe expect the operating leverage of airports to graduallyemerge in 2026 as passenger traffic continues to recover.However, the recovery of airport retail remains to be seen, andthe sector’s P/E valuation will take time to normalize. Amongairport companies, we think the growing popularity of inboundtravel to China will likely benefit large international airports. Wemaintain our ratings, earnings forecasts, and target prices forthe companies in our coverage universe. RisksSlower-than-expected growth in inbound tourist traffic and/orconsumption at airports; larger-than-expected capex. 【免责声明】本文仅代表第三方观点,不代表和讯网立场。投资者据此操作,风险请自担。

【免责声明】本文仅代表第三方观点,不代表和讯网立场。投资者据此操作,风险请自担。

【广告】本文仅代表作者本人观点,与和讯网无关。和讯网站对文中陈述、观点判断保持中立,不对所包含内容的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,并请自行承担全部责任。邮箱: